Saturday August 24, 2024

By Hussein Abdullahi Yusuf

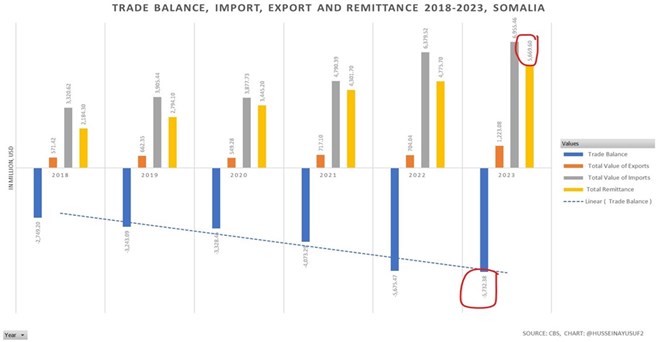

Somalis trade deficit has

significantly widened over the past six years. In 2018, Somalia faced a trade

deficit of USD 2.749 billion, which expanded to USD 5.7 billion by 2023. The

total import value increased from USD 3.3 billion in 2018 to USD 6.955 billion

in 2023, while the total export value grew from USD 571 million to USD 1.223

billion.

This trade imbalance has led to a

substantial outflow of foreign currency that has adversely impacted local

production capabilities as cheap imported goods flog the market, rendering

domestic production in an uncompetitive position.

Remittances constitute Somalia's

primary source of foreign exchange. These inflows are primarily used to fund

the country’s import bill, resulting in an outflow of U.S. dollars from

domestic circulation to pay foreign exporters to Somalia. In 2023, remittance

inflows totaled USD 5.6 billion, whereas the trade deficit was USD 5.7 billion.

This data indicates that the entirety of the remittance inflows was directed

towards settling the import bill, hence, the fund left the country with one

2023, without creating much long term value as depicted in the graph below.

Purpose of the article is to

explore the reasons behind the widening trade imbalance and suggest potential

solutions.

Trade deficit is defined as when

a country`s imports more goods and services than it exports, resulting in a

negative balance of trade. The total import value in 2018 was USD 3.3 Billion

while the total export value was USD 571 Million, leaving the country's trade

deficit of USD 2.749 Billion. Fast forward in 2023, the total import value was

USD 6.955 Billion while total export value was at USD 1.223 Billion, leaving

the country trade deficit of USD 5.732 Billion, as the below graph depicts.

The challenges constraining

Somalia's export capacity include limited funding, inadequate international

market access for value-added products, and insufficient infrastructure for

processing and storing goods. The country has experienced a trade deficit due

to a range of interconnected factors, which are rooted in both structural and

situational issues. Key causes include

Political Instability: Somalia has experienced prolonged periods of

conflict and instability, which have disrupted economic activities, including

trade and investment. The lack of a stable government and infrastructure has

made it difficult to manage and develop trade effectively.

Weak Infrastructure: Poor infrastructure, including inadequate road

network, and communication systems, hinders trade by increasing transaction

costs and reducing the efficiency of moving goods both within the country and

across borders.

Limited Industrial Base: Somalia’s industrial sector is relatively

under/not developed, leading to a heavy reliance on imports for manufactured

goods and capital equipment. This lack of domestic production capacity

contributes significantly to the trade deficit.

Dependence on Imports: The country relies heavily on imports for

essential goods, including food, fuel, and machinery. This high dependency

exacerbates the trade imbalance, as the value of imports often far exceeds that

of exports.

The primary causes of the trade

deficit are Somalia’s inability to produce goods and services, mainly food and

construction materials as those two categories dominate in our import bill.

Somalia imported USD 6.955

billion in 2023, compared to USD 6.080 billion in 2022. The main import

categories in 2023 were as follows:

|

Somalia import Categories

|

|

Category

|

2023 (Million USD)

|

% of the total imports

|

|

Food

|

2,002.52

|

28.8%

|

|

Construction

|

1,340.24

|

19.3%

|

|

Medical Products

|

797.89

|

11.5%

|

|

Cars & Spare parts

|

467.42

|

6.7%

|

|

Oil & Gas

|

560.00

|

8.1%

|

|

Others Including Khat

|

517.13

|

7.4%

|

|

Clothes & Footwear

|

460.26

|

6.6%

|

|

Personal Care

|

202.49

|

2.9%

|

|

Furniture and Utensils

|

143.70

|

2.1%

|

|

Electronics & E. Machines

|

158.71

|

2.3%

|

|

Beverages & Tobacco

|

105.55

|

1.5%

|

|

Cosmetics

|

106.29

|

1.5%

|

|

Plant Industry

|

62.23

|

0.9%

|

|

Stationary

|

31.04

|

0.4%

|

|

Total

|

6,955.46

|

|

This indicates that food,

construction, and medical products accounted for two-thirds of a percentage

point of the import bill. Specifically, food accounted for 28.8% in 2023.

Low Export Capacity: Somalia's export sector is constrained by

various factors, including the limited diversity of products mainly

concentrating on livestock-related products, low production levels, and

challenges in meeting international standards. Additionally, issues such as

insecurity and lack of access to global markets further limit export

opportunities.

Further, our limited export

capacity also exacerbates the gap, in 2023 the total export value was USD 1.223

Billion, and most of this export was livestock-related categories with little

value added.

|

Somalia Export Categories, In Millions, USD

|

|

Category

|

2022 (Million USD)

|

2023 (Million USD)

|

|

Livestock

|

558.38

|

1,069.4

|

|

Crops & Veg Oil

|

45.61

|

63.49

|

|

Meat

|

16.1

|

15.95

|

|

Forest Products

|

12.87

|

11.34

|

|

Others

|

13.06

|

35.61

|

|

Hides & Skins

|

7.04

|

7.33

|

|

Fishery

|

51.33

|

15

|

Security Concerns:

Persistent security issues, including terrorist attacks and internal conflicts,

deterred investment in the most fertile and productive areas of the country

including Juba Valley that are rich in agricultural. Moreover, concerns of

piracy attacks are hindering in fishery investments, which could have produced

fish that we can export to neighboring country including Ethiopia, where there

is a huge demand for seafood products for religious and health purposes. Therefore,

Security Concerns, further exacerbate Somalia’s trade balance.

Economic Mismanagement:

Issues such as corruption, nepotism, lack of effective economic policies,

talent mismanagement, not allocating the right man for the right job and poor

financial management exacerbate trade imbalances by creating inefficiencies in

public and private sectors and hindering economic growth.

International Trade Barriers:

Somalia faces barriers to trade such as tariffs, trade restrictions, sanctions,

and additional due diligence measures as the country`s weak quality assurance

protocols, affect its ability to engage effectively in global markets. In some

instances, Somali products are forced to be exported to another country to get

the label and license and then re-export to the destination.

Addressing

Somalia's trade deficit requires a comprehensive approach that involves

enhancing both the supply side and demand side of the economy. Here are several

strategies, along with examples from Sub-Saharan Africa (SSA) that have

implemented similar measures:

1. Improve Infrastructure

Strategy: Invest in infrastructure such as ports, and

roads, to facilitate trade and reduce transaction costs.

Examples:

Rwanda: The government has invested in

improving roads and logistics through the "Rwanda Transport

Infrastructure Project," which has streamlined the movement of goods

and bolstered trade.

2. Enhance Industrialization

Strategy: Develop local industries to reduce dependence

on imports and increase export capacity by focusing on value addition and

diversification.

Examples:

Kenya: The "Big Four Agenda"

includes industrialization as a key pillar. Kenya has invested in special

economic zones and industrial parks, leading to increased manufacturing

output and export diversification.

In Ethiopia, one industrial park alone -Hawassa

Industrial Park- employs more than 20,000 people.

3. Strengthen Governance and Reduce Corruption

Strategy: Implement better governance practices and

anti-corruption measures to create a more favorable business environment and

attract foreign investment.

Examples:

Botswana: Known for its strong governance

and low corruption levels, Botswana has created a stable business

environment that supports economic growth and trade.

4. Promote Export-Oriented Policies

Strategy: Develop policies that incentivize and support

the export sector, including export subsidies, tax incentives, and access to

international markets.

Examples:

South

Africa: The

government provides various incentives for exporters, including tax

rebates and support programs, which have helped South Africa maintain a

competitive edge in international markets.

5. Develop Human Capital and Skills

Strategy: Invest in education and vocational training

to develop a skilled workforce capable of supporting and growing the trade

sector.

Examples:

Ghana: The government’s focus on

education and skills development through initiatives like the

"Technical and Vocational Education and Training (TVET)"

programs has helped improve the labor force’s skills that support sectors

such as business process outsourcing, and ultimately supporting industrial

and export growth.

6. Enhance Trade Facilitation and Access to

Global Markets

Strategy: Improve trade facilitation measures such as

customs procedures and trade agreements to better integrate into the global

economy.

Examples:

Somalia

joining the East Africa Communities is very successful endeavor. Additionally,

we should also focus on joining other trade communities in Middle East to

further our business relations.

7. Foster Public-Private Partnerships

Strategy: Encourage collaboration between the

government and private sector to drive investment and innovation in

trade-related activities.

Examples:

Nigeria: The Nigerian government has

partnered with private investors to develop infrastructure and industrial

projects, aiming to enhance trade and economic growth.

Somalia: The

recent regulation approved by council of ministries pertaining to

Public-Private Partnerships is welcoming start; however, the government

should materialize this relation by allowing the private sector to engage

more in business.

8. Enhance

Access to Finance

Strategy:

Improve access to finance for businesses to support investment in key sectors,

industrial development, and trade activities.

Examples:

Nigeria: The

Central Bank of Nigeria’s intervention programs, such as the Anchor

Borrowers' Program, provide funding to small and medium-sized enterprises

(SMEs), supporting their growth and export capacity.

9. Invest in Energy Infrastructure and Develop

Regional Energy Integration

Strategy:

Integrate with regional and neighboring energy markets to access a broader

energy supply, reduce energy prices and create economies of scale.

Examples:

West Africa: The

West African Power Pool (WAPP) facilitates cross-border electricity trade,

improving energy security and supporting regional economic growth.

Somalia: The

current energy price of USD 0.42 per Kilowatt in Somalia is unaffordable

and cannot support for industrial growth. Energy importation from

neighboring countries is viable alternative to combat higher energy costs.

Renewable energy is another alternative in which funds can be secured from

the Gulf countries or international financial institutions.

Implementing

these strategies in Somalia would involve tailored approaches considering the

country's specific context and challenges. By learning from the experiences of

other SSA and DCs, Somalia can develop a multi-faceted strategy to address its

trade deficit effectively.

Hussein Abdullahi Yusuf is a consultant,

economist and financial sector analyst in Eastern Africa and MENA.

Contacts

Email:

[email protected]

Tell:

+252611698907

Facebook: https://www.facebook.com/profile.php?id=100069787405612&mibextid=ZbWKwL

X: https://x.com/HusseinAYusuf2?t=y-Snvyo2rdz0_KVyuSyWjw&s=35

References

(Central Bank of Somalia, 2024) Quarterly-Economic-Report_Q4_2023_09-06-24.pdf