SIEPRA INSTITUTE

Tuesday April 2, 2019

Somali Institute for Economic Policy Research and Analysis Policy Brief (SIEPRA)

Following the recognition of the Federal Government of Somalia by the International Monetary Fund (IMF) in 2013, the Central Bank of Somalia in cooperation with the IMF initiated technical work on the rebuilding the monetary and financial framework of the country. After decades of civil war having eroded confidence in the existing currency and resultant problems of counterfeiting, dollarization and runaway inflation, the Federal Government in the post-conflict landscape, identified the reform of the national currency as a high political priority. By 2018, the process of currency reform in a phased manner was already in advanced stages of planning, with assistance from the IMF and other institutions. This policy brief presents an overview of the economic and political scenario of Somalia for execution of monetary interventions, the feasibility and desirability of introduction of a new currency and concrete implementation strategies available to policymakers.

BACKGROUND

Failure of the Official Banking System

In the 1980s, before the collapse of the Somali state, Somalia was already experiencing distressing monetary circumstances marked by bank failures and financial chaos. The Central Bank had begun to lose control of the money supply, becoming a tool for financing the government’s huge budget deficit. While the official banking system was losing public confidence, a parallel market was gaining traction with the growth of small informal financers.With the outbreak of the civil war in 1991, there was a complete disappearance of the formal government banks and the destruction of records.

The Hawala (Remittance) System

Counterfeit Currency and Runaway Inflation

Further, after years of use, the Somali banknotes in circulation were literally falling apart. The felt need for liquidity was addressed by the illegal printing of currency by warlords, businessmen and regional administrations since 1992. Initially, these groups acted conscientiously, as a kind of Central Bank, issuing money in controlled portions and in some cases, even buying back excess cash. But with the entry of more market players and rival factions, the import of counterfeit currency proliferated. This had a devastating impact on the economy, eroding the market value of the meagre earnings of the ordinary people. The runaway inflation came to a head in 2007 with the import of printing machines which flooded the market with fake currency. Prices began to rise at a dizzying pace, faster than the traders could revise their prices.

Dollarization and Mobile Money

The depreciating value of the Somali shilling was compounded by its unpredictability and high risk, giving way to a preference for theUS dollar. This created difficulties for the ordinary people who had limited access to dollars.The 1000-shilling note (the only one in circulation) exchanges for 1/23rd of a dollar. Thus, it is used only as fractional currency for the dollar or for lower value transactions and is becoming increasingly obsolete. The dollarization has been facilitated in recent years by mobile money, which allows even small-scale transactions in dollars. The use of mobile money is widespread with over 30% of the population reliant on it, according to a survey conducted by the Gates Foundation and the World Bank.

Present Status of the Somali Shilling

The current Somali shilling lacks the basic characteristics of a currency. Consisting exclusively of the1000-shilling note, the Somali shilling is not divisible.

Moreover, due its low value and purchasing power, it is not easily portable. This has led to a quasi-dollarization of the economy and it is estimated that unless it is collected and changed to a new currency, the Somali shilling could disappear in a few years. A survey conducted by the Somali Institute for Economic Policy Research and Analysis (SIEPRA)in Mogadishu and Baidoa reveals an overwhelming consensus 88% in favour of a replacement of the old currency with a new one, as represented in the following graph.

The Somali shilling also struggles with legitimacy in Hiiraan Province, Aabudwaak, Galgaduud , and the areas controlled by the militants .

Need for Monetary Stability

It is clear from the above analysis that in Somalia, like in many post-conflict countries, one important early challenge is to overcome inflation and preserve price stability. Price volatility has an impact not only on the purchasing power of the public but is also known to deter business investment and weaken economic growth. This is already observed in Somalia which is plagued by a dependence on imports for basic commodities including food and where there is rampart poverty. A 2017 World Bank report finds that many people in Somali live in poverty, living below 1.90 dollars a day. Thus, the need to restore the currency and payments system, which can provide a medium for transactions and a store of value, cannot be overstated.

Role of a Central Bank

This task cannot fall upon disparate market players like businessmen or faction leaders, as during the civil war but needs to be entrusted with the Federal Government. Here, it is equally important to keep in mind the importance of fiscal discipline to ensure that currency printing does not degenerate into profligate deficit financing. This goal of monetary stability can be achieved through a strong and independent central bank. The central bank would have to fulfil the vital functions of providing adequate liquidity, managing currency, ensuring availability of trade finance in the short run and restoring the credit system in medium term.The role of theCentral Bank of Somalia (CBS) is recognized by the Constitution of Somalia which, under Article 23,makes it responsible for formulating and implementing financial and monetary policies.

Strengthening the Central Bank of Somalia

Having established the role of the CBS in reconstructing the financial sector of Somalia, it is now worthwhile to adjudge its capacity to discharge such a role. In 2009, when the CBS was reopened at the end of the war, the institution lacked the necessary human and financial resources or an appropriate governance structure. Since then, much improvement can be noted: the CBS Act which clearly outlines the powers and functions of the CBS has been passed, a Governor and Board of Directors have been established and the new leadership has sought to upgrade the institutional capacity of the CBS with technical assistance from the IMF and other international financial institutions. Further measures whose implementation would strengthen the CBS include:

- Recruitment of qualified staff through competitive testing, and regular skill enhancement through training programmes;

- Augmenting the monitoring and auditing capacity of the CBS, including regulatory self-control;

Establishment of prudential regulations both for commercial banking institutions and non-banking financial institutions; and - Political coordination and consensus-building with regional monetary authorities.

Collection and analysis of large-scale statistical data for information on inflation and other real macroeconomic indicators.

Revitalising Somali Banking

The primary objective of the CBS, as stated in Article 4 of the CBS Act is to achieve and maintain domestic price stability. Theoretically, the CBS can use various monetary policy instruments to contain inflationary pressure, including increasing borrowing fee rates, selling treasury bills, raising reserve mandates for commercial banks, etc.

However, these instruments are not applicable to Somalia because there is no money market or bond market in Somalia, and the whole banking system is yet to develop. Therefore, before delving into currency reform, which is a priority for the CBS, it is pertinent to discuss the formalization of the banking and financial sector. The role envisaged for the CBS by the Constitution encompasses licensing and supervision of commercial banks and non-banking financial institutions. The goal for the longer-term should be a transition into a full two-tier banking system, with the CBS at the apex. Bank failures in the pre-conflict era means that this goal would only be achievable through the establishment of new commercial banks.

REPLACING OLD CURRENCY

Non-viability of the Old Currency

As discussed earlier, the Somali shilling is not a functional currency since it lacks the basic characteristics of divisibility and portability, which prevent it from being a viable unit of account. Similarly, its price volatility (compounded by counterfeiting) means that it is no longer useful as a medium of exchange or a store of value. The unpopularity of the Somali shilling can be demonstrated through the results of a survey conducted by the SIEPRA Institute in Mogadishu and Baidoa where in 88% of the participants polled in favour of replacing the old currency. Various policy directions are available to the Federal Government, when it comes to replacing the old currency.

Concerns with Adoption of the US Dollar

One oft-suggested option would be to formally adopt a foreign currency (such as the dollar) to fully replace the Somali shilling. This approach, implemented in Timor Leste and Kosovo, obviates the need for the central bank to manage the country’s monetary base. It imports the track record of stability of the currency chosen, which can establish currency stability immediately and without the need for domestic monetary policy capabilities. The move is especially practical and cost-effective in countries where a foreign currency is already widely in use. In Somalia, formal adoption of the dollar would serve to officially validate the de facto dollarization of the economy. Dollarization also removes any possibility for financing government expenditure by printing money. This is almost universally considered an advantage because the possibility of central bank lending to the government has historically proven an irresistible temptation with well-known inflationary consequences, as is also witnessed in Somalia’s own history. There may be occasions, however, when external or supply shocks (which post-conflict countries are prone to) could be mitigated by monetary adjustments, unavailable as a tool to dollarized economies. It has been observed that the dollar option can be useful as a temporary measure, buying the Government time to focus on effectively rebuilding the capacity and competence of the banking system. But, in the longer run, it faces the drawback of loss of seigniorage revenue from printing its own currency, for the Government. Further, even if envisaged for the short-term, dollarization once formally established is very difficult to reverse.

New Currency Options

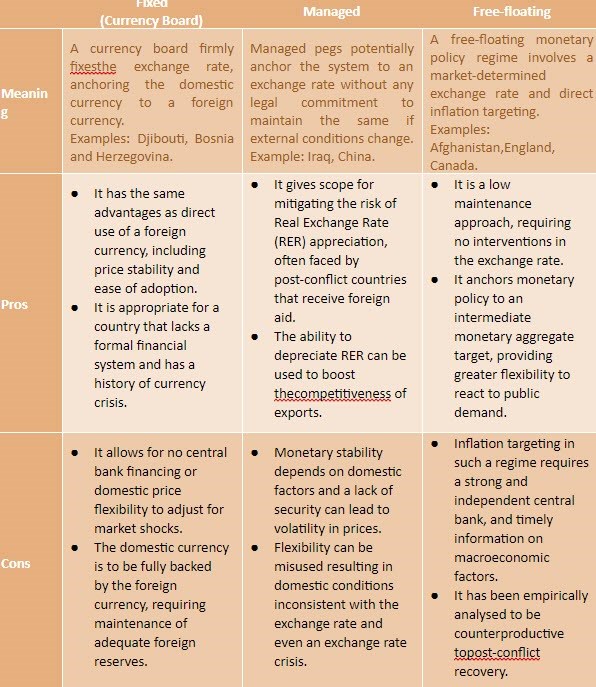

Accordingly, it is important to consider other currency possibilities. If the dollar option is not selected, then a new Somali currency would have to be introduced. From a political point of view, this approach is a no-brainer: the authorities view the new currency as an important ‘symbol of national sovereignty and unity’ of Somalia. Further, it allows the Central Bank to capture the seigniorage profits. But the introduction of a new currency comes with challenges of its own. At the very outset, this approach presents further policy questions in the form of the choice of monetary policy regime to be adopted – fixed (currency board arrangement), managed, or free-floating. The pros and cons of these regimes are discussed in the table below.

The choice of monetary policy regime depends on the unique circumstances of the country in question. The Federal Government and the CBS have been considering various options but at the end of the day, the coherence of the policies and actions to implement monetary policy are more important than the regime itself.

Failure of Prior Currency Intervention Plans

In January 2010, the then Transitional National Government had initiated the printing of Somali shilling banknotes worth 5 trillion with printing assistance from the Government of Sudan, at an estimated cost of 17 million US dollars. However, the delivery of this money was halted after meeting strong opposition from the international community and concerned Somali citizens on the grounds of inadequate planning and lack of requisite preparatory measures for the introduction of a new currency. There was an apprehension that, absent a comprehensive policy framework, the currency would only add to the monetary chaos already afflicting the country.

CHALLENGES

Accordingly, before going forward with the introduction of a new currency, it is incumbent on the government to foster the right environment and commit to addressing the various issues that hinder the establishment of an effective financial system.

1. Political Consensus

Given the current frosty relations between the Federal Government and Federal Member States (FMS) could boycott any new currency, which could, in turn, deepen the political crisis. An agreement would have to be reached with the Federal Member States (FMS) administrations before the introduction of a new currency.

2. Security

Despite significant progress on security in recent years, the Federal Government does not control the whole country. The Federal Government along with the Federal Member States must secure and take control of the whole country.

Tackling Corruption

As of 2018, Somalia is ranked the 180th (out of 180 countries) in Transparency International’s Corruption Perceptions Index.

In this backdrop, the Federal Government and the CBS would have to implement accountability and transparency measures to rebuild public trust in financial institutions, including International Financial Institutions such as, IMF and the World Bank. This trust would help Somalia Federal Government progress towards loan forgiveness program.

3. Fiscal Discipline

Monetary policy is effective when supplemented by a responsible fiscal policy promoting economic stability and growth. Money creation to pay for government deficit expenditure must be checked through an appropriate legal framework and political will. The reliance on foreign aid also needs to be gradually weaned out.

4. Funding

Over 50 million US dollars are estimated to be required for the successful introduction of a new currency, in adequate quantities.Considering that the entire Federal Government budget for 2018 equalled 274 million US dollars, the estimated cost of printing would not be bearable by Somalia; by itself .Further investment would also likely be necessary for mitigating the potential inflationary risks of the injection of a new currency to the markets.

WAY FORWARD. INTRODUCING A NEW CURRENCY

Steps in the Currency Printing Process

The Federal Government has announced its plans of printing a new currency for Somalia. This introduction of the new banknotes will mark the first time that the CBS is issuing currency since 1991. It will help the authorities bring an end to the extensive counterfeiting. In the longer run, it is hoped that the new currency will gain widespread acceptance and ultimately, aid the CBS in maintaining monetary stability. Issuing anew currency is an enormous operational undertaking, containing numerous important policy steps. These include:

1.Naming the currency – The very name of a country’s currency has immense symbolic value. It is often designated in the local language and may contain political significance. A survey conducted by SEIPRA in 2019 in Mogadishu and Baidoa revealed that about 60% of the participants were not in favour of changing the name of the currency from the ‘shilling’ to a new name, as can be observed from the following chart.

↓

2. Designing the currency – This step involves practical choices of material, sizes, layout, colours, typefaces, etc. Images and icons of national importance are often selected, while keeping in mind the overall aesthetic appeal. Special security features to render counterfeit difficult also need to be included. In 2018, the designs of some of the planned currency notes were released publicly.

↓

3. Determining currency denominations–This step is critical to ensuring the divisibility and portability of money. It is especially imperative in countries where a depreciation of the old currency has been witnessed. The pre-existing denominations may no longer be useful for day-to-day business transactions. In some cases, a devaluation of the currency may be undertaken in order to simplify the units. In Somalia, the denominations for the new currency have not been announced. The potential denominations options are 1000, 2000, 5000 and 10000 Somali Shillings. SEIPRA survey also determined the choice of denominations of the participants polling in favour of the 500 and 1000 shilling denominations. The results have been represented in the following chart.

The survey seems to indicate a preference among participants for rationalisation of currency denominations to smaller units.

↓

4. Choosing a printer– The choice of printer is a key decision to be made, considering the scope for abuse in the selection process. The scope for abuse is not only limited to nepotism and corruption leading to reduced cost-effectiveness and quality, but there is also a scope for control of printing plates by criminal elements giving rise to a potential for counterfeiting. Therefore, the selection must be made through a competitive bidding process, involving reputed (preferably international) printers.

↓

5. Deciding on the quantity of the new currency to introduce – This step involves deliberation as to the quantities of new currency of each denomination to be introduced. The introduction may be undertaken in a phased manner, in which case, quantities for introduction in every phase need to be decided. In making these choices, due consideration must be given to the available budgetary resources, as well as to the inflationary risks of injection of new currency into the market.

6.Deciding a date and mechanism for conversion – The mechanism for conversion of old currency notes may be through direct physical replacement or with the help of bank deposits. An appropriate conversion rate for old-to-new notes would also have to be determined. In Somalia, the conversion mechanism must be decided upon fairly, keeping in mind that a bulk of the counterfeit notes in circulation are in the hands of ordinary people, who have legitimately received the notes in exchange for goods and services. The date of conversion must also be chosen strategically to ensure that counterfeiters do not print old currency notes for replacement.

↓

7.Announcing and publicizing the conversion plan – This step is of utmost importance since the entire currency replacement programme would be rendered moot in the absence of public awareness and acceptance of the new currency. The Federal Government of Somalia has been up front with information regarding its plans for the new currency, but greater efforts would be required at the final stage of announcement of the conversion plan in order to reach the remotest parts of the country.

Additional Policy Measures

Besides the printing of the new currency, administrators would also have to prepare for various other aspects of introducing a new currency in replacement of an old one. These include:

- Logistics management for storage and distribution of new currency notes, as well as collection and destruction of old currency notes;

- Creating a legal framework including preparation of CBS Regulations and currency operations manuals;

- Strengthening the accountability aspects of the currency reform such as financial auditing and independent evaluation reports; and Developing an anti-counterfeiting strategy with the cooperation of Somali law enforcement agencies and technology up gradation.

Financing Currency Reforms

The CBS intends to introduce the new currency in two phases. The 1st phase involves the exchange of counterfeit Somali shilling notes currently incirculation with fiat Somali shilling banknotes.Beyond this, any injection of new Somalishilling banknotes will only take place during the 2nd phase. The requisite preparatory measures for introduction of the new currency in 1st phase, have been implemented. The latter phase will require significant preparatory work, including strengthening the institutional capacity of the CBS and developing independent monetary policy instruments and reserve management guidelines. The 1st phase has been deemed by the IMF as ready for implementation and has been budgeted at 41 million US dollars, covering all aspects of the issuance and distribution on the new currency. The authorities will need the support of the donor community to raise the needed funds for the project.

Somali Institute of Economic Policy Research & Analysis (SIEPRA) is an autonomous research organization based in Mogadishu, Somalia.

Contact: [email protected]

REFERENCES

AuesScek. (n.d.). Somalia – Monetary Reform Agenda. Retrieved from https://www.academia.edu/6760161/Somalia_Monetary_Reform_Agenda_CONTENTS|

Camilla Petra, UN Migration News Desk. (January 19, 2018). At the Heart of the Somali Economy – Introducing Monetary Policy From Within. Retrieved from https://weblog.iom.int/heart-somali-economy-–-introducing-monetary-policy-within

Harun Maruf, VOA News. (October 6, 2017). Somalia Months Away From Having New Currency. Retrieved from https://www.voanews.com/a/somalia-months-away-from-new-currency/4059086.html

Ibrahim Elbadawi and Raimundo Soto, Dubai Economic Council. (November 10, 2010). Exchange Rate and Monetary Policy for Sustainable Post-conflict Transition. Retrieved from http://economia.uc.cl/docs/dt_392.pdf

International Monetary Fund. (May 11, 2018). Somalia: Currency Reform Assessment Letter for the Central Bank of Somalia. Retrieved from https://mof.gov.so/publication/somalia-currency-reform-assessment-letter-central-bank-somalia

Mohamed Dalmar, WardheerNews. (January 2, 2015). Somalia: The long road to currency reform. Retrieved from https://wardheernews.com/wp-content/uploads/2015/02/Somalia-Monetary-policy-By-Dalmar.pdf

Somali Public Agenda. (August 11, 2018). Is it the time to print a new currency for Somalia? Retrieved from http://somalipublicagenda.com/is-it-the-time-to-print-a-new-currency-for-somalia/

US Agency for International Development. (January 2009). A Guide To Economic Growth In Post-Conflict Countries. Retrieved from http://pdf.usaid.gov/pdf_docs/PNADO408.pdf

Warren Coats, International Monetary Fund. (August 2, 2005). Monetary Policy Issues in Post Conflict Economies. Retrieved from https://works.bepress.com/warren_coats/9/