Wednesday May 22, 2024

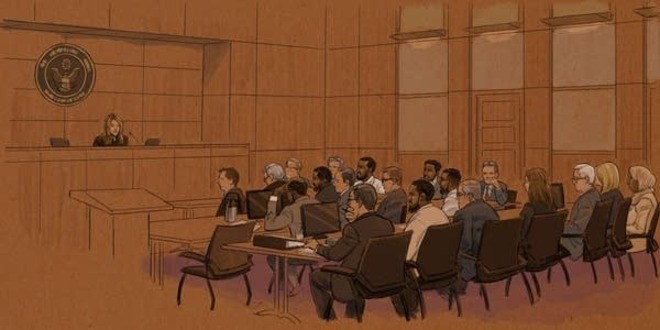

The seven defendants in the first Feeding our Future trial appear in a Minneapolis federal courtroom along with their attorneys. Cedric Hohnstadt

Minneapolis (HOL) — An FBI forensic accountant testified Tuesday that Empire Cuisine, a Shakopee-based restaurant, received $25 million in federal funds but spent only $3 million on food, revealing a pattern of significant financial fraud in the Feeding Our Future trial.

Pauline Roase, the accountant, detailed how her investigation into 3,000 bank accounts uncovered a scheme where millions of dollars intended for child nutrition were diverted for personal use, including luxury vehicles and real estate. The trial involves seven defendants accused of stealing $40 million through false meal reports and is part of a broader $250 million federal investigation.

The defendants, including Abdiaziz Farah and Mohamed Jama Ismail, co-owners of Empire Cuisine, face 41 charges such as wire fraud, bribery, and money laundering. They allegedly created limited liability companies (LLCs) to conceal fraudulent transfers, further complicating the financial trail.

Roase's testimony highlighted how Empire Cuisine pivoted from being a food site to a food vendor after the state dropped it from the program. This allowed them to continue receiving federal funds despite spending a fraction on actual food for children. Empire Cuisine spent $3.1 million on food, but much of it was on items like tea and halal meat, which matched the restaurant’s menu but did not meet federal program requirements. Prosecutors say the additional funds were used for personal luxury purchases, including high-end vehicles and real estate investments abroad. Abdiaziz Farah, for instance, allegedly pocketed over $8 million, and other defendants similarly benefited from the scheme.

ThinkTechAct Foundation, another nonprofit involved, began receiving substantial deposits in early 2021, raising suspicion due to its previously dormant status. Large checks labeled for the Child and Adult Care Food Program (CACFP) were instead used for personal expenses, including a $725,000 investment in Kenyan real estate.

Roase identified a pattern of creating new LLCs just before receiving federal funds, suggesting a deliberate attempt to obfuscate the financial trail. The funds were transferred through multiple entities to hide their misuse.

Citing pandemic-related regulatory waivers, defense attorneys argue that their clients operated within the bounds of the law by leveraging federal programs to address child hunger. They claim that regulatory waivers allowed for-profit businesses to benefit from the program. However, the prosecution argues that the defendants exploited these waivers to siphon off millions meant for child nutrition.

"The government decided to use the power of the American free enterprise system to meet these needs," said Andrew Birrell, representing Abdiaziz Farah.

The broader investigation has charged 70 individuals so far, with 18 pleading guilty. The trial’s outcome could have significant implications for federal oversight of pandemic relief funds. This large scandal has led to the dissolution of 17 state nonprofits implicated in similar schemes. Minnesota Attorney General Keith Ellison announced the court-ordered shutdowns due to fake addresses, non-compliance with reporting requirements, and financial misuse, which undermined public trust and diverted funds meant for vulnerable children.

The crackdown followed revelations from Hadith Ahmed, a former Feeding Our Future employee who turned state witness. Ahmed's testimony exposed the inner workings of the fraud, leading to numerous charges against individuals, including the yet-to-be-tried former executive director of Feeding Our Future, Aimee Bock.

Earlier in the trial, IRS Special Agent Joshua Parks testified that names on attendance rosters were often fabricated or duplicated across multiple sites, some miles apart. Only a handful of names matched local school district records. The rosters included fictitious names like “Unique Problem” and “Friday Donations,” suggesting systematic falsification to inflate meal counts and claim higher reimbursements.

Internal Revenue Service's Special Agent Brian Pitzen testified about text messages among defendants coordinating the distribution of reimbursement money. The communications showed a focus on dividing profits rather than legitimate meal distribution. Jurors were shown video evidence of minimal food distribution activities compared to the inflated claims.

Testimony is set to resume, with the prosecution expected to call additional witnesses before the defense presents its case. The case's resolution could impact how federal relief funds are monitored in the future.