Thursday October 8, 2015

By Fred Aminga

Some of Kenya’s flagship projects that were premised to leverage on the spirit of cost-sharing across borders could be lampooned by parallel interests, as some partners in the Horn of Africa fasttrack financing other projects.

Landlocked Ethiopia, which was aiming to reap from Lamu port, has partnered with Djibouti to construct a 550-kilometre fuel pipeline in what could affect her appetite for fully participating in the Lamu Port-South Sudan-Ethiopia Transport (Lapsset) corridor.While Lapsset was designed to be a route to the sea for a number of countries—with Uganda and South Sudan being the priority—Rich Management chief executive Ally-Khan Satchu feels there will be some disappointments post the Djibouti-Ethiopia deal.

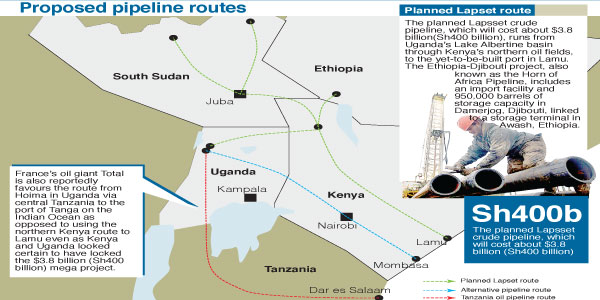

“I think Kenya was in a beauty pageant on this one and obviously Djibouti plus financing was compelling (for Ethiopia),” he said. Meanwhile, France’s oil giant Total is also reportedly suggesting an alternative route for a shared pipeline between Uganda and Lamu, in what could slow attainment of Kenya’s oil dream as the low cost of international crude oil weigh on prospects of commencement.

The firm favours the route from Hoima in Uganda via central Tanzania to the port of Tanga on the Indian Ocean as opposed to using the northern Kenya route to Lamu even as Kenya and Uganda looked certain to have locked the $3.8 billion (Sh400 billion) mega project.

With the current low prices of crude oil, there is little incentive for companies such as Tullow Oil, Africa Oil, China’s CNOOC and Total to spend in the project.

Satchu says the decline of oil prices below $50 (Sh5,150) a barrel, and a forward curve which does not have the price crossing $60 (Sh6,180) until 2020, could be the real push behind the cost-benefit analysis being fronted by those opposing the north-eastern route.

“I suspect this is a fait accompli and unless (Japanese prime minister) Shinzo Abe is going to fund Lamu (through Toyota), then the Lamu route is essentially a non-starter,” he said, adding that the move confirms that Kenya cannot rest on its laurels.

“It confirms what many industry insiders feel, which is that Bagamayo-Tanga-Dar es Salaam might provide a more cost-effective route to the sea,” said Satchu, adding that the mpasse could last for as long as prices stay at low levels. Commodity and oil companies are slashing budgets to better align themselves with this new price normal.

If investors favour the new route, it could deal a blow to Kenya’s timelines and cost estimates because such mega projects are premised on the principle of cost sharing. A classic example is the Keystone Pipeline System linking Canada and the United States, which has not been completed since it started way back in 2010.

However, other oil experts say all is not lost because discussions of such magnitudes actually take longer to be actualised. Energy expert and former National Oil Corporation boss Mwendia Njoka says such deals take time to finalise because a lot is usually at stake and the various stakeholders involved must be made happy.

“We have not seen the last of this yet. In any case, after all stakeholders are satisfied, we have to go to the financial markets for the funds,” he said, adding that this is not a phenomenon unique to developing countries.